Getting My Feie Calculator To Work

Table of ContentsThe smart Trick of Feie Calculator That Nobody is DiscussingA Biased View of Feie CalculatorThe smart Trick of Feie Calculator That Nobody is DiscussingAll about Feie CalculatorThe smart Trick of Feie Calculator That Nobody is Talking AboutThe Main Principles Of Feie Calculator The smart Trick of Feie Calculator That Nobody is Talking About

If he 'd regularly traveled, he would certainly instead complete Part III, noting the 12-month period he satisfied the Physical Existence Examination and his traveling background. Step 3: Coverage Foreign Income (Component IV): Mark earned 4,500 per month (54,000 yearly).Mark determines the exchange price (e.g., 1 EUR = 1.10 USD) and converts his wage (54,000 1.10 = $59,400). Since he lived in Germany all year, the percentage of time he resided abroad during the tax is 100% and he goes into $59,400 as his FEIE. Finally, Mark reports overall wages on his Kind 1040 and gets in the FEIE as an adverse amount on time 1, Line 8d, reducing his gross income.

Picking the FEIE when it's not the ideal option: The FEIE may not be ideal if you have a high unearned revenue, earn greater than the exclusion limit, or reside in a high-tax country where the Foreign Tax Credit Score (FTC) may be more helpful. The Foreign Tax Credit (FTC) is a tax obligation decrease approach usually utilized in conjunction with the FEIE.

Some Known Incorrect Statements About Feie Calculator

expats to offset their united state tax financial obligation with foreign revenue taxes paid on a dollar-for-dollar reduction basis. This indicates that in high-tax nations, the FTC can commonly eliminate U.S. tax obligation debt completely. The FTC has restrictions on qualified tax obligations and the optimum claim amount: Qualified taxes: Only earnings taxes (or taxes in lieu of revenue taxes) paid to foreign federal governments are qualified (Digital Nomad).

tax responsibility on your international revenue. If the international tax obligations you paid surpass this limit, the excess foreign tax can generally be carried forward for up to 10 years or returned one year (using an amended return). Maintaining accurate documents of international earnings and taxes paid is as a result crucial to determining the appropriate FTC and keeping tax compliance.

expatriates to minimize their tax liabilities. If a United state taxpayer has $250,000 in foreign-earned income, they can omit up to $130,000 using the FEIE (2025 ). The continuing to be $120,000 might then be subject to taxes, however the united state taxpayer can possibly apply the Foreign Tax Credit report to balance out the taxes paid to the international country.

The Feie Calculator PDFs

He offered his United state home to establish his intent to live abroad permanently and used for a Mexican residency visa with his better half to help meet the Bona Fide Residency Examination. Neil aims out that purchasing building abroad can be challenging without very first experiencing the area.

"It's something that individuals require to be actually persistent regarding," he says, and suggests expats to be careful of usual blunders, such as overstaying in the United state

Neil is careful to stress to Tension tax authorities that "I'm not conducting any carrying out in Service. The U.S. is one of the few countries that tax obligations its citizens regardless of where they live, implying that even if a deportee has no earnings from U.S.

Not known Details About Feie Calculator

tax return. "The Foreign Tax Credit scores enables people working in high-tax countries like the UK to offset their United state tax obligation by the quantity they've currently paid in tax obligations abroad," states Lewis.

The prospect of lower living prices can be alluring, yet it frequently comes with trade-offs that aren't promptly evident - https://johnnylist.org/FEIE-Calculator_304769.html. Housing, as an example, can be a lot more inexpensive in some countries, however this can indicate endangering on facilities, security, or accessibility to trusted utilities and solutions. Low-cost buildings could be situated in locations with irregular net, limited public transport, or undependable healthcare facilitiesfactors that can significantly influence your daily life

Below are a few of the most often asked questions concerning the FEIE and various other exemptions The International Earned Income Exclusion (FEIE) permits U.S. taxpayers to omit as much as $130,000 of foreign-earned income from government income tax, reducing their U.S. tax obligation. To get approved for FEIE, you have to fulfill either the Physical Visibility Examination (330 days abroad) or the Authentic Residence Test (show your main residence in an international country for an entire tax year).

The Physical Visibility Examination likewise calls for United state taxpayers to have both an international revenue and a foreign tax home.

Feie Calculator Things To Know Before You Buy

An income tax treaty between the U.S. and one more country can assist prevent dual taxes. While the Foreign Earned Revenue Exemption minimizes gross income, a treaty may give extra advantages for qualified taxpayers abroad. FBAR (Foreign Bank Account Record) is a called for filing for united state residents with over $10,000 in foreign monetary accounts.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax expert on the Harness platform and the creator of The Tax obligation Man. He has more than thirty years of experience and currently concentrates on CFO services, equity payment, copyright taxation, cannabis tax and separation relevant tax/financial planning issues. He is an expat based in Mexico.

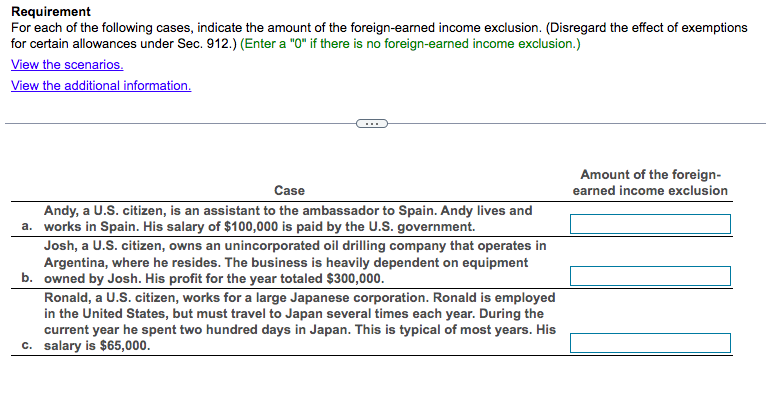

The foreign made income exclusions, occasionally described as the Sec. 911 exclusions, leave out tax obligation on salaries earned from functioning abroad. The exclusions make up 2 components - a revenue exemption and a real estate exemption. The complying with Frequently asked questions go over the advantage of the exclusions consisting of when both partners are expats in a basic manner.

5 Easy Facts About Feie Calculator Shown

The revenue exclusion is currently indexed for inflation. The optimal yearly income exclusion is $130,000 for 2025. The tax obligation benefit leaves out the earnings from tax obligation at lower tax rates. Formerly, the exclusions "came off the top" lowering income based on tax obligation at the top tax prices. The exemptions may or may not minimize revenue used for other purposes, such as individual retirement account limits, child credit histories, individual exceptions, and so on.

These exemptions do not spare the wages from US tax however merely offer a tax obligation reduction. Keep in mind that a bachelor working abroad for all of 2025 who gained concerning $145,000 without various other earnings will have taxed revenue reduced to no - successfully the same answer as being "tax obligation cost-free." The exemptions are computed on a daily basis.

If you participated in business meetings or seminars in the United States while living abroad, revenue for those days can not be omitted. For US tax it does not matter where you maintain your funds - you are taxable on your globally earnings as a United States person.